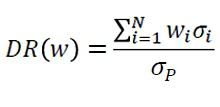

Portfolio diversification formula

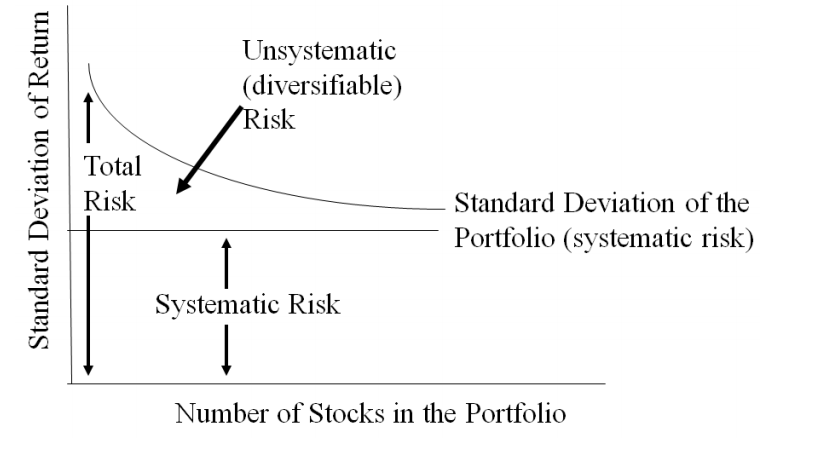

Too few stocks and one blowup hurts the portfolio by a noticeable amount. The formula for calculating an.

The Portfolio Diversification Effect Youtube

Too many stocks and you run the risk of a very expensive index fund.

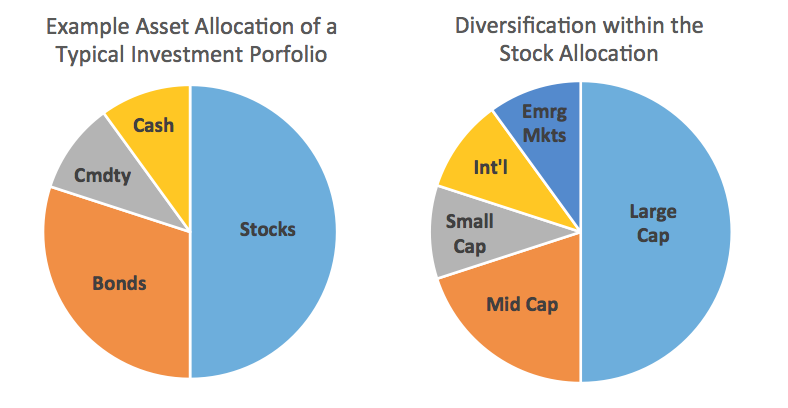

. Ad Public Fixed Income Private Placement Debt Real Estate. Ad Expand Clients Portfolios Discovering Wealth Opportunities In The Least Expected Places. A solid investment portfolio often contains.

The expected return of the portfolio is. The rationale behind this technique contends that a portfolio. Pretty simple right.

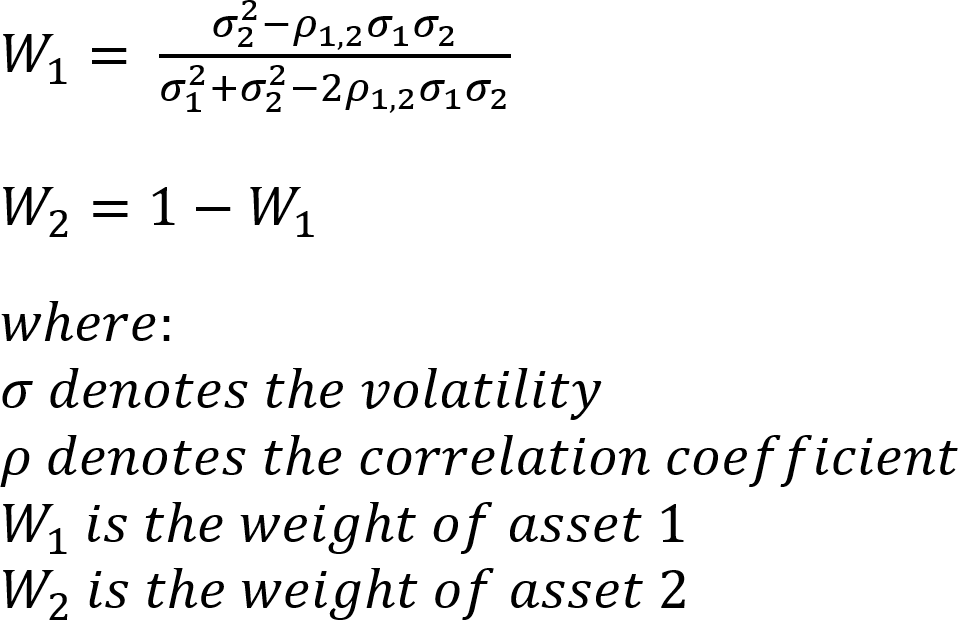

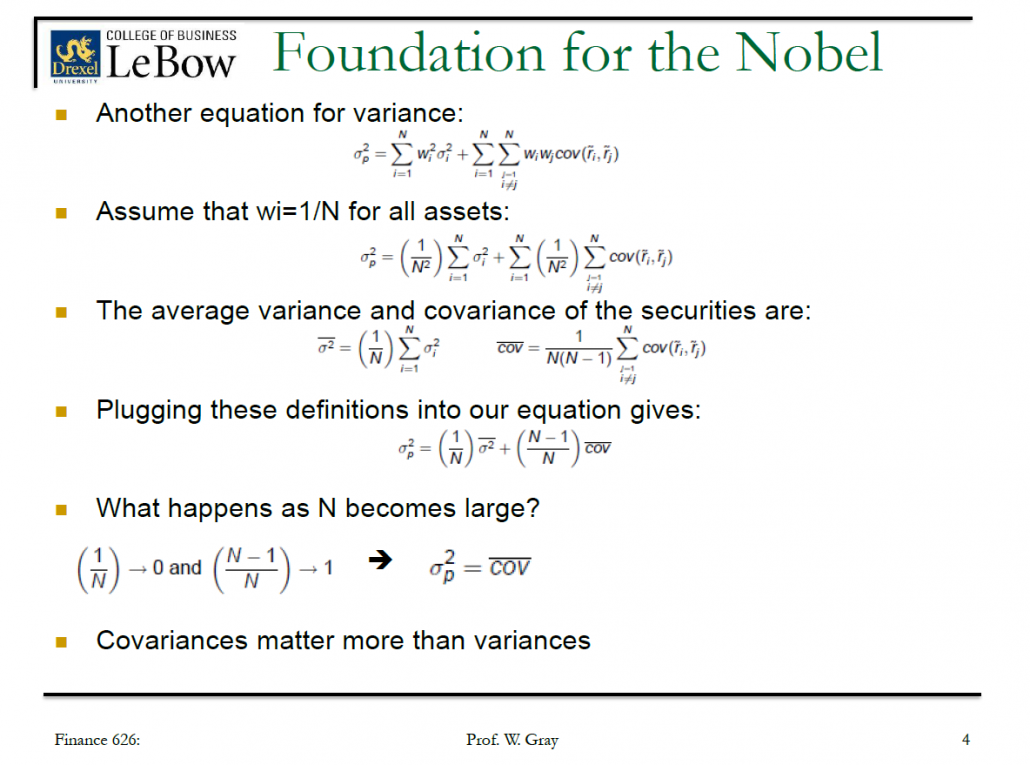

Portfolio diversification is one of the most useful skills of a professional investor since the goal of diversification is reduction of the portfolio risks while preserving the yield. As the number of assets grows we get the asymptotic formula. W i the weight of the ith asset.

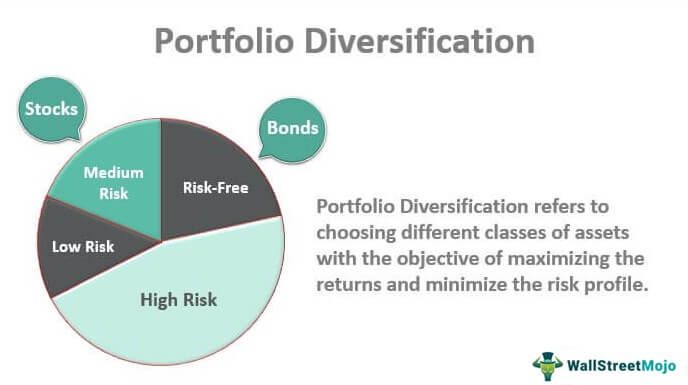

Help Your Clients Reach Their Goals W One Of Our Top Performing Funds. Learn more about MetLife Investment Management. Portfolio diversification or selecting a diverse group of assets to limit risks while increasing possible returns is a solid rule of thumb.

The formula for portfolio variance is given as. Find Solutions To Help Meet Client Goals. Ad An Experienced Portfolio Management Team Focused On Continued Strong Client Outcomes.

Ad Expand Clients Portfolios Discovering Wealth Opportunities In The Least Expected Places. I have written many times. The weight of one asset multiplied by its return plus the weight of the other asset multiplied by its return.

The overall volatility of Portfolio 1 was previously computed as 217. Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. Var Rp w21Var R1 w22Var R2 2w1w2Cov R1 R2 Where Cov R1 R2 represents the covariance of the two asset.

Ad Explore How Investing Sustainably Can Address Client Demand. Formula for Portfolio Variance. Domestic consumers utility function is given by u cH α cF α where cj α denotes state α consumption of good j j H F.

The variance for a portfolio consisting of two assets is calculated using the following formula. Help Your Clients Reach Their Goals W One Of Our Top Performing Funds. The correlation coefficient is calculated by taking the covariance.

The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N. For Portfolio 1 the volatility associated with maximum diversification is computed as 94 see Figure 2. Thus the goodsindifference curve is given by u cH α cF.

The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N. Expected Return 40005000 10 10005000 3 08 10 02 3 86 Standard Deviation Standard. Thus in an equally weighted portfolio the portfolio variance tends to the average of covariances between securities as the.

The correlation coefficient is calculated by taking the covariance of the two assets divided by the product of the standard deviation of both assets. With a concentra-tion ratio of 50 the example portfolio has the. Get Details About Our Core-Plus Bond Fund And See If It Works For Your Client.

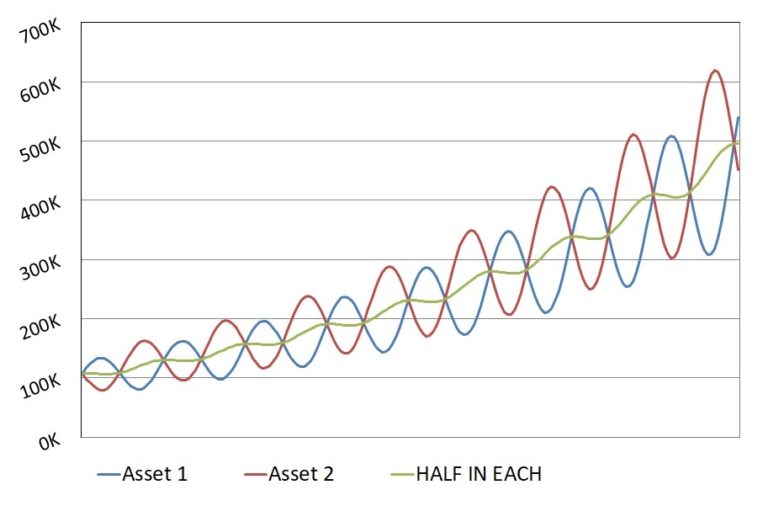

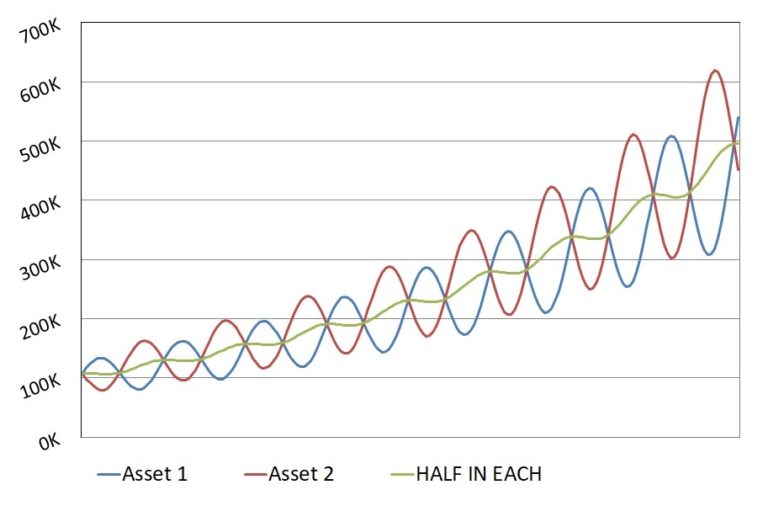

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Solactive Diversification The Power Of Bonds

Diversification

Efficient Diversification Ppt Video Online Download

Finance Portfolio Variance Explanation For Equation Investments By Zvi Bodie Quantitative Finance Stack Exchange

Investment Analysis And Portfolio Management Lecture 3 Gareth Myles Ppt Download

Portfolio Diversification Correlation Risk Management Prudent Investors

Portfolio Diversification How To Diversify Your Investment Portfolio

Standard Deviation And Variance Of A Portfolio Finance Train

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Asset Allocation And Diversification Chartschool

How Many Stocks Make Up A Well Diversified Portfolio Seeking Alpha

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

Time Diversification Redux Research Affiliates

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Modern Portfolio Theory 2 0 The Most Diversified Portfolio Seeking Alpha

Div62 Gif